For founders navigating 2023: Why you need to have a secondary strategy

For Founders Navigating 2023: Why you need to have a secondary strategy

Secondaries as a tool for startups

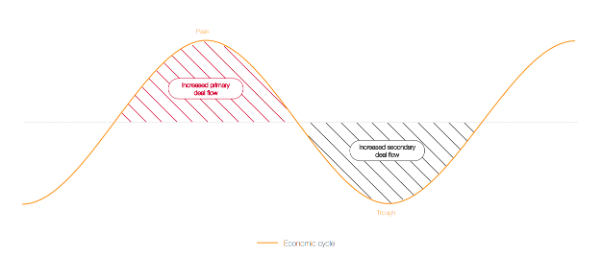

2023 has already dealt a series of blows to the Venture Capital industry, including the run on Silicon Valley Bank and a drastic slowdown in funding – recent data from GlobalData revealed that as of the end of February this year, the number of UK VC deals had already dropped by 38% year-on-year with valuations failing also.[i] But there is one subsector of the industry that tends to pick up whilst everyone else takes stock: secondaries.

Private secondary transactions are not always well-publicised due to their confidential nature, but it is becoming increasingly apparent that this is an area of immediate opportunity for both companies and investors. A report released in Q1 2023 by Lazard has shown private secondary transactions of over $100bn took place in 2022[ii], and the latest predictions suggest that this will grow in 2023 to $130-150bn.[iii] They might pass under the radar, but secondary transactions are on the rise; now is the time to leverage them as a key tool for growth.

What are venture capital secondary transactions?

There is limited literature dedicated to demystifying secondary transactions in venture capital given the cloud of confidentiality which often surrounds such processes. In essence, these transactions involve an investor buying shares in a private company from an existing shareholder (such as another investor or the company’s employees). Unlike a ‘primary’ fundraising process, which is designed to raise fresh capital for the business, the consideration paid in secondary deals goes directly to the seller and does not create any new equity or cash for the company; it is simply a transfer of shares from one shareholder to another. This is reflective of what happens every day for listed companies on the stock market but given that startups generally have less stock available and tend to be more sensitive to valuations, venture capital secondary transactions are less frequent and much less public than listed secondary transactions.

How can startups currently benefit from the secondary market?

A secondary transaction won’t usually replace a fundraise, but it can complement the fundraising process and add a new dimension to a company’s cap table and board. For example, secondaries offer startups the opportunity to update their pool of investors without giving away any additional equity. Early-stage investors such as Angels and seed-stage VCs can be invaluable when a company is starting out but as the business begins to scale, it may make sense to bring on specialised growth-stage investors who are experienced in this specific stage of expansion but also are more likely to provide further primary capital to companies. This becomes particularly relevant in times of economic volatility where growth is often stifled, and investors’ advice may be more heavily relied upon as they can draw upon relevant data and lessons from their whole portfolio. The difficult macro environment also makes a full-blown fundraise less attractive for many companies given the likelihood of less favourable terms, and a longer, more drawn-out process. Bringing new experienced secondaries investors on board can also help companies increase the likelihood of internal round of fundings with more capital available. Secondaries can therefore serve as a mechanism for restructuring the board and bringing on new expertise while circumventing the challenges of a formal fundraise. Wise (formerly TransferWise), highlighted bringing on new investors and rewarding earlier investors as a key motivation in their 2020 secondary share sale which saw the company leap to a $5bn valuation.[iv] Secondary sales of early shares in Depop, prior to its $1.6bn sale to Etsy, similarly served to ‘clean up the cap table’ in this way.[v]

In a period where many startups are being cash conservative, and many employees are struggling with rising costs of living, secondary sales of early employee shareholdings could also be an effective alternative way of rewarding longstanding team members and encouraging them to stay during more turbulent times. A report by Crunchbase showed that a typical SaaS company will take around nine years to exit from inception.[vi] Offering key employees the chance to reap some of the rewards of their hard work prior to a company-wide exit can be a great way of improving their satisfaction and driving hard work for years to come.

Additionally, when it comes to early employees or even founders that have already departed the company, a secondary sale of their stake can ensure that only those still actively committed to growing the business remain on board. Often, ex-employees or founders that cash-out in this way will go on to reinvest into new startups which further fuels the ecosystem. This is great at any point but in difficult fundraising conditions it could be particularly valuable to other startups.

With all these economic factors at play, it is clear that secondaries are a critical consideration in the current startup ecosystem and one that all startups could leverage to navigate 2023 and beyond.

[i] https://itwire.com/it-industry-news/market/venture-capital-funding-by-uk-startups-plunges-70-1-to-us$2-bilion.html

[ii] https://lazard.com/research-insights/lazard-2022-secondary-market-report/

[iii] https://uk.news.yahoo.com/private-equity-industry-secondary-market-050016607.html

[iv] https://sifted.eu/articles/transferwise-hits-5bn-valuation-after-secondary-share-sale/

[v] https://www.secondariesinvestor.com/tempocap-nets-11x-on-depop-secondary-exit/